Everything about the Foreign Earned Earnings Exemption: Optimizing Your Standard Deduction Perks

The Foreign Earned Revenue Exemption (FEIE) presents a beneficial opportunity for united state citizens living abroad to lessen their tax obligation obligations. Understanding the eligibility standards is crucial for those seeking to take advantage of this exclusion. Moreover, declaring the typical deduction can improve total tax obligation benefits. Nonetheless, managing this procedure includes mindful interest to information and an awareness of typical risks. Exploring these aspects can give clarity and maximize potential tax obligation advantages.

Understanding the Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exemption (FEIE) enables united state people and resident aliens working abroad to leave out a part of their international earnings from government revenue tax. This provision functions as a monetary alleviation device, allowing migrants to keep a larger share of their earnings gained in foreign nations. By minimizing gross income, the FEIE aids minimize the worry of dual taxes, as individuals might additionally be subject to tax obligations in their host countries. The exclusion uses only to earned revenue, which includes earnings, incomes, and professional costs, while passive revenue and financial investment gains do not qualify. To profit from the FEIE, people need to submit certain forms with the IRS, detailing their international earnings and residency - FEIE Standard Deduction. Recognizing the nuances of the FEIE can greatly influence economic preparation for U.S. citizens living overseas, making it crucial for migrants to stay notified concerning this useful tax obligation provision

Eligibility Criteria for the FEIE

To get approved for the Foreign Earned Income Exemption (FEIE), individuals should fulfill particular eligibility standards. This consists of rewarding residency requirements, passing the physical visibility examination, and developing a tax obligation home in an international nation. Each of these aspects plays a vital duty in figuring out whether one can gain from the exemption.

Residency Demands

Satisfying the residency requirements is essential for individuals seeking to get the Foreign Earned Earnings Exclusion (FEIE) To be qualified, taxpayers should develop a bona fide home in an international nation or countries for an undisturbed duration that usually spans an entire tax obligation year. This requirement highlights the necessity of a much deeper connection to the international area, moving past simple physical existence. Individuals need to demonstrate their intent to reside in the foreign country and have developed their living circumstance there. Factors such as the size of remain, sort of housing, and local community participation are considered in identifying residency. Satisfying these criteria is crucial, as failure to do so may invalidate one from benefiting from the FEIE.

Physical Visibility Examination

Developing eligibility for the Foreign Earned Revenue Exemption (FEIE) can also be attained through the Physical Visibility Examination, which requires individuals to be physically existing in a foreign nation for at the very least 330 complete days throughout a successive 12-month duration. This test is useful for those who may not meet the residency need but still live abroad. The 330 days need to be full days, suggesting that any day spent in the USA does not count toward this total amount. It is essential for people to preserve accurate documents of their traveling dates and areas to support their claims. Efficiently passing this examination can considerably minimize taxable income and enhance economic outcomes for migrants.

Tax Obligation Home Place

Tax home location plays a necessary duty in identifying eligibility for the Foreign Earned Earnings Exclusion (FEIE) To qualify, an individual need to develop a tax home in a foreign nation, which indicates their primary place of organization is outside the United States. This is unique from a mere residence; the individual have to conduct their job in the foreign country while preserving a considerable link to it. The internal revenue service requires that the taxpayer can show the intent to stay in the international place for an extensive period. Furthermore, maintaining a home in the united state can make complex qualification, as it might suggest that the individual's real tax obligation home is still in the United States. Recognizing this requirement is crucial for making the most of FEIE advantages.

Exactly how to Assert the FEIE on Your Income Tax Return

Asserting the Foreign Earned Income Exemption (FEIE) on a tax return needs mindful attention to information and adherence to particular internal revenue service standards. Taxpayers need to initially confirm eligibility by meeting look what i found either the authentic residence examination or the physical existence test. Once qualification is validated, they should complete internal revenue service Form 2555, which information international earned revenue and appropriate details regarding their tax obligation home.

It is vital to report all foreign revenue properly and maintain proper paperwork to support cases. Taxpayers should also understand the optimal exclusion restriction, which is subject to annual changes by the internal revenue service. Filing Kind 2555 alongside the annual income tax return enables taxpayers to exclude a part of their foreign incomes from U.S. tax. It is suggested to consult a tax obligation professional or Internal revenue service sources for updated information and assistance on the FEIE procedure, guaranteeing compliance and maximization of potential benefits.

The Standard Deduction: What You Required to Know

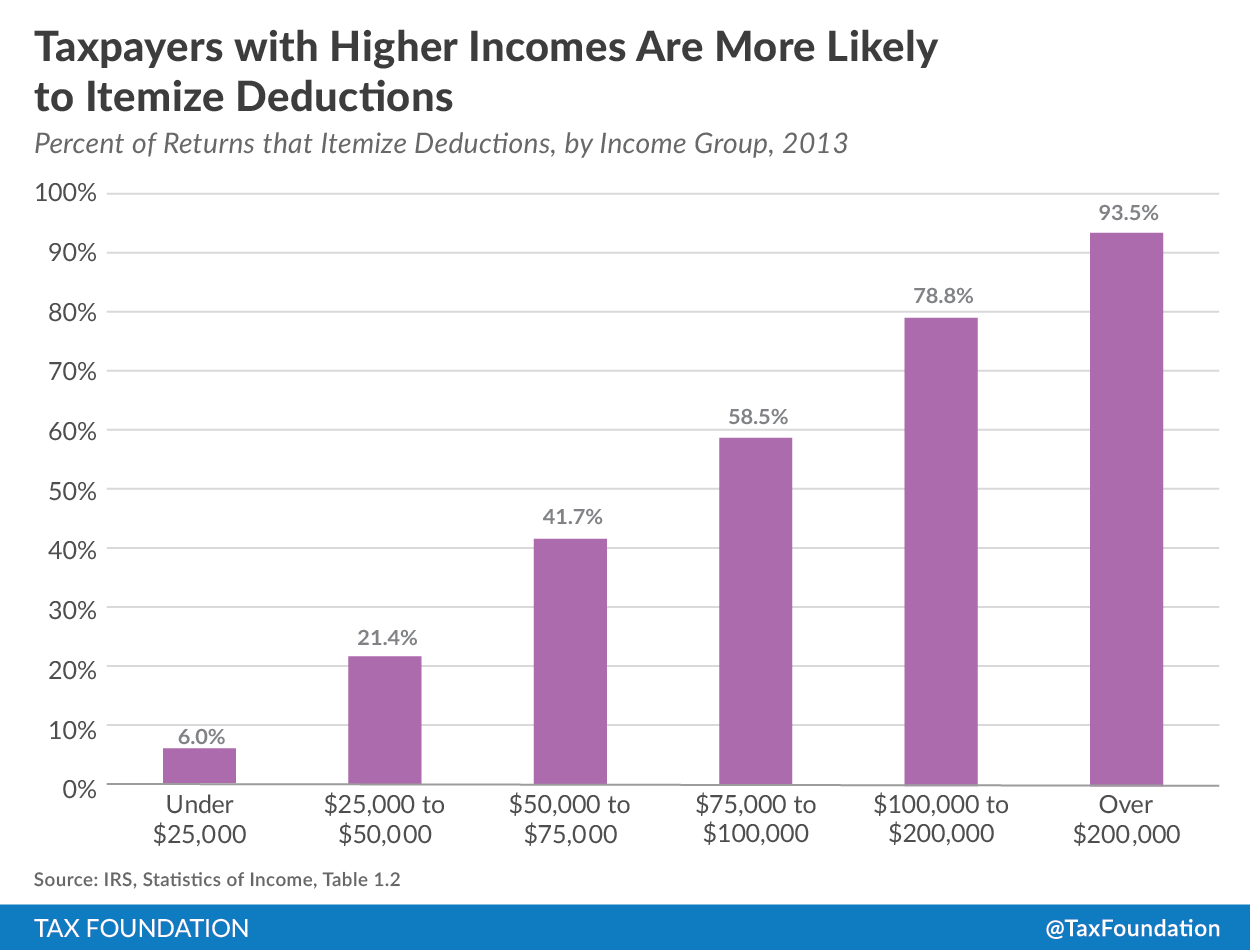

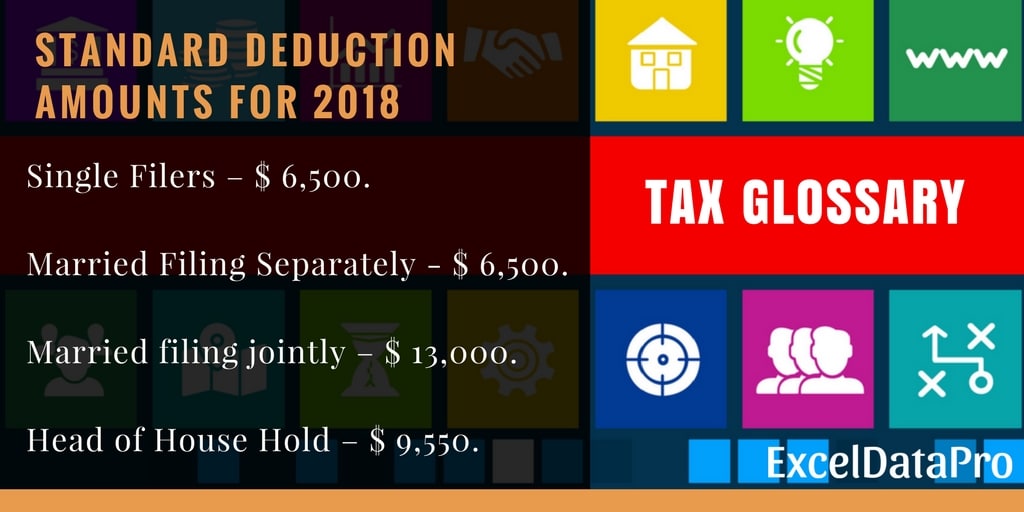

How does the common reduction effect taxpayers' total financial circumstance? The basic reduction offers as a considerable tax obligation benefit, lowering gross income and potentially lowering tax obligation obligations. For the tax obligation year 2023, the standard deduction is set at $13,850 for single filers and $27,700 for married pairs filing collectively. This reduction simplifies the declaring procedure, as taxpayers can go with it rather of making a list of reductions, which calls for detailed record-keeping.

Taxpayers gaining foreign revenue may still declare the standard deduction, taking advantage of reduced gross income even while using the Foreign Earned Revenue Exclusion (FEIE) Nonetheless, it is vital to note that the standard deduction can not be incorporated with itemized deductions for the very same tax obligation year. As a result, comprehending the basic deduction allows taxpayers to make informed choices concerning their tax techniques, maximizing offered benefits while guaranteeing conformity with internal revenue service laws

Techniques for Optimizing Your Reductions

Optimizing reductions under the Foreign Earned Earnings Exemption requires a clear understanding of earned revenue restrictions and the advantages of declaring housing exclusions. In addition, making use of Kind 2555 efficiently can boost the capacity for substantial tax financial savings. These strategies can considerably impact the total tax obligation obligation for migrants.

Understand Gained Revenue Limits

While many migrants seek to minimize their tax obligation problem, comprehending the made income restrictions is essential for effectively leveraging the Foreign Earned Earnings Exclusion. The Internal Revenue Solution (IRS) sets specific thresholds that dictate the optimum amount of foreign made revenue eligible for exemption. For the tax obligation see year 2023, this limitation is $120,000 per certified person. Surpassing this limit may result in taxation on the earnings above the limit, decreasing the benefits of the exclusion. To maximize deductions, migrants should maintain exact documents of their international earned revenue and analyze their eligibility for the exemption annually. Strategic intending around these restrictions can greatly enhance tax financial savings, permitting migrants to maximize their economic circumstance while living abroad.

Asserting Real Estate Exclusion Advantages

Numerous expatriates ignore the potential benefits of claiming the Housing Exclusion, which can substantially minimize their taxable income. This exemption permits people living abroad to deduct certain real estate costs from their gross earnings, making it much easier to meet financial responsibilities without incurring considerable tax responsibilities. To maximize this advantage, expatriates ought to confirm they certify based on their home and work circumstances. Additionally, comprehending eligible expenses-- such as rental fee, utilities, and maintenance-- can enhance the total deduction. Maintaining extensive records of these expenses is vital for confirming insurance claims. By purposefully maneuvering through the Real estate Exclusion, expatriates can significantly lower their tax worry and keep even more of their revenues while living overseas, eventually enhancing their financial health.

Make Use Of Type 2555 Effectively

Utilizing Kind 2555 successfully can greatly enhance the economic benefits available to expatriates, specifically after benefiting from the Real estate Exclusion. This kind allows individuals to claim the Foreign Earned Earnings Exemption, which can significantly minimize taxed earnings. To make best use of deductions, expatriates should validate they meet the certifications, consisting of the physical visibility test or the authentic residence examination. It is vital to properly report all international made income and to maintain comprehensive documents of eligibility. Additionally, making use of the Housing Exemption in tandem with Kind 2555 can even more reduce total tax obligation responsibility. By understanding the intricacies of these types, migrants can maximize their tax situation and maintain more of their hard-earned earnings while living abroad.

Common Mistakes to Prevent When Declaring Your Tax Obligations Abroad

Frequently Asked Concerns

Can I Claim Both FEIE and the Foreign Tax Obligation Debt?

Yes, a person can claim both the Foreign Earned Income Exemption (FEIE) and the Foreign Tax Obligation Credit (FTC) They need to ensure that the exact same revenue is not utilized for both advantages to prevent double benefits.

What Occurs if I Exceed the FEIE Income Restriction?

Surpassing the Foreign Earned Income Exclusion (FEIE) income limitation leads to the ineligibility for the exemption on the excess quantity. This could bring about taxable earnings in the USA, calling for proper tax filings.

Are There Any Type Of State Tax Obligation Implications for FEIE?

State tax obligation implications for the Foreign Earned Revenue Exclusion (FEIE) vary by state. Some states may exhaust foreign revenue while others adhere to government exemptions, making it necessary for individuals to consult state-specific tax laws for clearness.

Just How Does FEIE Affect My Social Security Advantages?

The Foreign Earned Income Exclusion (FEIE) does not directly affect Social Safety and security advantages. Earnings left out under FEIE might impact the computation of ordinary indexed month-to-month profits, potentially affecting future advantages.

Can I Withdraw My FEIE Political Election After Asserting It?

Yes, an individual can withdraw their Foreign Earned Income Exclusion (FEIE) election after claiming it. This retraction must be carried out in composing and sent to the internal revenue service, sticking to certain guidelines and due dates.

Recognizing the Foreign Earned Income Exclusion (FEIE)

The Foreign Earned International Exclusion EarningsExemption) allows U.S. enables and resident aliens working abroad functioning exclude a leave out of part foreign earnings from incomes income governmentRevenue Taxpayers gaining international income may still declare the standard reduction, profiting from decreased taxed income also while making use of the Foreign Earned Income Exclusion (FEIE) Optimizing deductions under the Foreign Earned Revenue Exclusion requires a clear understanding of gained revenue limitations and the advantages of asserting housing exemptions. While several migrants seek to decrease their tax obligation worry, comprehending the made revenue limits is important for successfully leveraging the Foreign Earned Revenue Exemption. Going Beyond the Foreign Earned Income Exemption (FEIE) earnings restriction results in the ineligibility for the exclusion on the excess quantity.